Our Investment Strategy

Our Investment Strategy

Our Investment Strategy

Built on a deep understanding of San Diego's unique real estate market and our ability to create value through strategic renovations and developments.

Our Equation for Success

Strategic Acquisition + Value-Add Renovations + ADU Integration = Equity Creation at Stabilization

Strategic Acquisition + Value-Add Renovations + ADU Integration = Equity Creation at Stabilization

01

Supply Constraints

San Diego's Supply Constraint San Diego functions as an "island" in terms of real estate supply, creating a persistent shortage of quality housing. We capitalize on this scarcity to deliver much-needed residential units.

02

Value-Add Opportunities

We target neglected properties with untapped potential. While many owners allow their buildings to deteriorate due to rising rents, we see these as prime opportunities for transformation.

03

Cost-Effective Renovations

Our renovation costs for existing buildings are significantly lower than ground-up development expenses, allowing us to create value more efficiently.

04

Exclusive Relationships

We maintain a unique partnership with our general contractor as their sole client. This allows us to manage the construction buying process, enabling our contractor to focus on swift project completion.

05

Density Optimization

By incorporating Accessory Dwelling Units (ADUs), we lower the total cost per unit to sub-$300k in an area where the average home costs $1 million and quality apartments trade between $400-500k per unit.

This approach allows us to deliver high-quality, affordable housing solutions while generating attractive returns for our investors in San Diego's competitive real estate market.

This approach allows us to deliver high-quality, affordable housing solutions while generating attractive returns for our investors in San Diego's competitive real estate market.

01

ASSET CLASSES

Class A and B Office High-Quality Retail Industrial (Warehouse, Distribution, Light Manufacturing)

02

Deal size

$50M - $500M+

03

INVESTMENT STRATEGIES

Core Plus

Value-Add

Opportunistic

04

TARGET MARKETS

United States -

- Gateway Cities (New York, Los Angeles, Chicago, San Francisco, Boston)

- High-Growth Secondary Markets (Austin, Denver, Nashville, Raleigh-Durham, Miami)

Europe

Asia Pacific

05

PROPERTY CHARACTERISTICS

Well-located assets with strong market fundamentals

Properties with potential for operational improvements and/or capital appreciation

Stable cash flows and attractive risk-adjusted returns

Why San Diego?

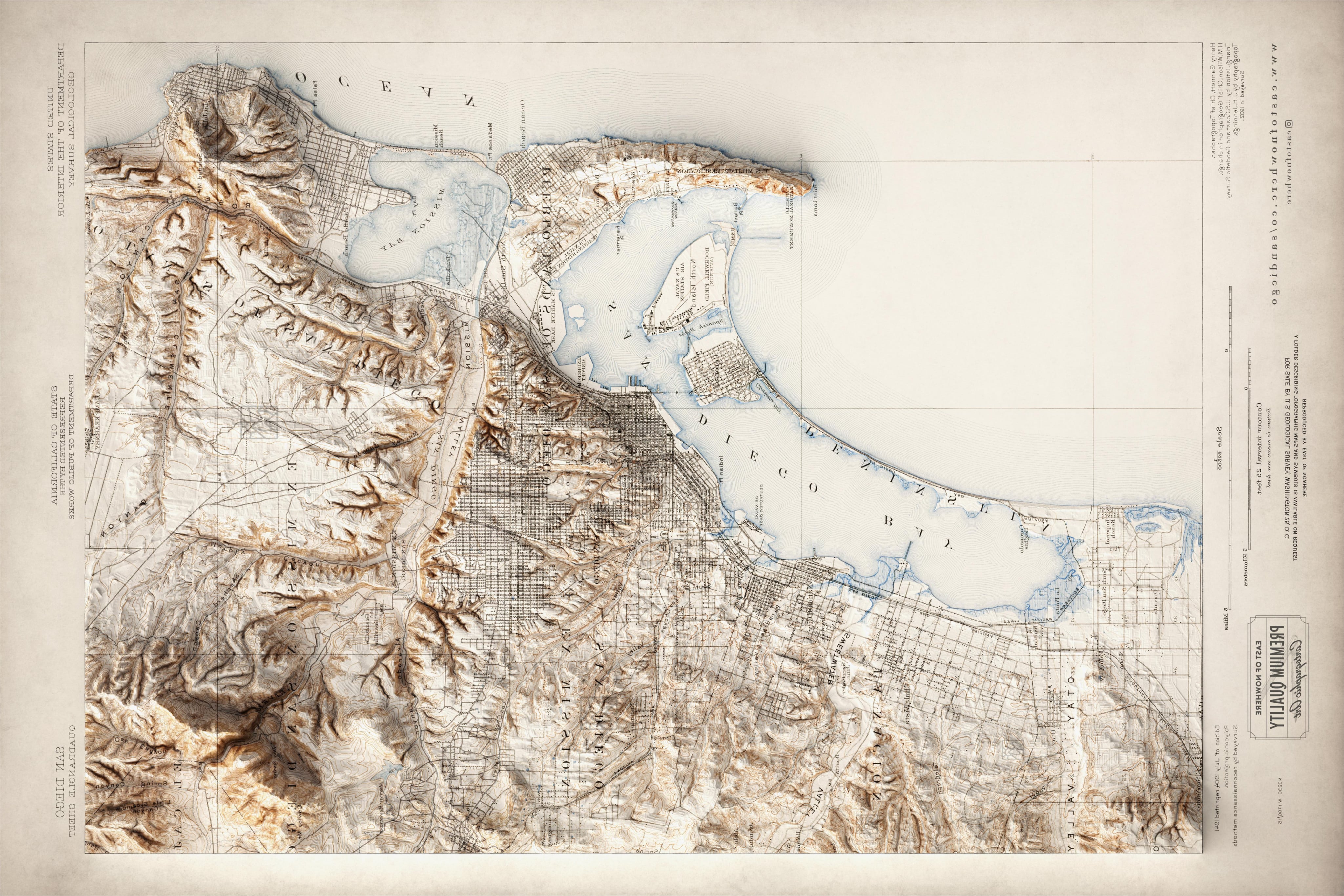

San Diego's unique geography creates a distinctive real estate landscape, effectively turning the city into an "island" for development. This exceptional setting is defined by natural boundaries on all sides.

San Diego's unique geography creates a distinctive real estate landscape, effectively turning the city into an "island" for development. This exceptional setting is defined by natural boundaries on all sides.

To the South

The international border with Mexico

To the East

Rugged mountain ranges

To the North

Camp Pendleton military base

To the West

The vast Pacific Ocean

These geographic constraints significantly limit the expansion of new housing developments in traditional ways. As a result, San Diego faces a unique challenge in meeting its growing housing demands. Our approach focuses on revitalizing and repurposing properties within the city, adding value and increasing housing supply without expanding the urban footprint.

These geographic constraints significantly limit the expansion of new housing developments in traditional ways. As a result, San Diego faces a unique challenge in meeting its growing housing demands. Our approach focuses on revitalizing and repurposing properties within the city, adding value and increasing housing supply without expanding the urban footprint.

Value Creation Strategy

K&M Development’s value creation strategy is built on our formula

K&M Development’s value creation strategy is built on our formula

01

Strategic Acquisition

02

Value-Add Renovations

03

ADU

Integration

=

04

Equity Creation at Stabilization

“This made me keenly aware that it paid to look at the real estate business not as an end in itself but as a device for bridging gaps between the needs of disparate groups. The greater the number of separate groups (or their needs) that one could interconnect (satisfy), the greater the profit to the innovator-entrepreneur.” - William Zeckendorf

01

ASSET CLASSES

Class A and B Office High-Quality Retail Industrial (Warehouse, Distribution, Light Manufacturing)

02

Deal size

$50M - $500M+

03

INVESTMENT STRATEGIES

Core Plus

Value-Add

Opportunistic

04

TARGET MARKETS

United States -

- Gateway Cities (New York, Los Angeles, Chicago, San Francisco, Boston)

- High-Growth Secondary Markets (Austin, Denver, Nashville, Raleigh-Durham, Miami)

Europe

Asia Pacific

05

PROPERTY CHARACTERISTICS

Well-located assets with strong market fundamentals

Properties with potential for operational improvements and/or capital appreciation

Stable cash flows and attractive risk-adjusted returns

Target Focus

Specialization in San Diego, Operating in Five Submarkets.

Specialization in San Diego, Operating in Five Submarkets.

North Park

University Heights

Normal Heights

City Heights

Kensington

GET IN TOUCH

619-713-9743

info@kandmdevelopment.com

2398 San Diego Avenue,

San Diego, CA 92110

© 2024 K&M Development LLC. All rights reserved.

GET IN TOUCH

619-713-9743

info@kandmdevelopment.com

2398 San Diego Avenue,

San Diego, CA 92110

© 2024 K&M Development LLC. All rights reserved.

GET IN TOUCH

619-713-9743

info@kandmdevelopment.com

2398 San Diego Avenue,

San Diego, CA 92110

© 2024 K&M Development LLC. All rights reserved.

GET IN TOUCH

619-713-9743

info@kandmdevelopment.com

2398 San Diego Avenue,

San Diego, CA 92110

© 2024 K&M Development LLC. All rights reserved.